Growth as usual?

Last month, a report issued by the California Department of Finance indicated Inland Southern California will likely double to 8 million residents by 2050. Whether all 4 million new residents show up within the next 40 years or not, recent history indicates the region can still expect a large influx of new residents.

As we previously noted, the million-dollar question is whether Inland Southern California will follow current patterns and continue sprawling farther outward? Or, will local officials, developers and residents alike begin accepting the need to begin growing smarter?

Two recent news items may give an indication of where we’re headed. One article gives us hope that change is coming, specifically that both local governments and developers are beginning to add density — and diversity — to their mix of projects. The other article, however, gives us cause for concern and points to the notion that it is — and will be — “business as usual” in the ever-sprawling Inland region.

First, the good. Banking giant Wells Fargo recently announced the consolidation of various offices scattered about the region into a single, 5-story office building in the Hospitality Lane area of San Bernardino. Although we would have preferred to see the consolidation take place within downtown San Bernardino — or even downtown Riverside — the Hospitality Lane area indeed is a very successful campus-style commercial development. As such, its densities are not quite that of a downtown area, but at least a single 5-story building beats five, 1-story tilt-ups taking up five times the land area.

Second, the not so good. A recent article highlighted developers looking ahead toward the next wave of housing growth — specifically, where it’ll likely take place. In our opinion, the article displayed several problems for the future of this region if current development patterns are not changed sooner rather than later.

In particular, two aspects concerned us the most. One, the fact that most developers tend to be eyeing residential projects (as opposed to a balance of housing and employment projects):

Even amid the biggest housing slump of the past decade, Inland developers and planners are not asking if or when the market will rebound — but where.

… Economists have forecast the housing market may not pick up until the end of next year at the earliest. In the meantime, some developers have turned their attention to commercial and industrial real estate, while others are focused on acquiring land to hold.

The Press-Enterprise

And second, that such development will likely be sprawling, single-family oriented development, simply gobbling up the next available tract of land:

…Most developers acknowledge there are obstacles to overcome in sprawling development — from getting water to all the new homes to alleviating extra traffic on the freeways — nevertheless, they say, growth will occur.

The Press-Enterprise

We feel these two notions must begin to change, most notably at the local government levels. Simply put, local governments must begin decreasing sprawl-oriented development, especially in the residential arena, as well as increase zoning for future employment centers, else the region will predominantly consist of sprawled-out bedroom communities — and long commutes:

Much of the attractiveness of southwest Riverside County comes from its position between Riverside and San Diego, said Randall Lewis, executive vice president of Upland-based Lewis Group of Cos., another developer involved in several projects in that portion of the county.

“That means it’s got a big commuter market,” he said.

The Press-Enterprise

Is being even more of a “commuter market” what we really should be planning — much less aiming — for?

Bottom line here is that it’s a lot easier — and cheaper — to zone ahead for impending commercial/employment uses now rather than having to rezone/redevelop pockets of existing residential uses later (which some of the region’s older cities may find, in some instances, is closer to reality than they realize).

Fortunately, there is some hope as Riverside County is working to tackle the jobs/housing imbalance where it counts — in land-use matters. With its Riverside County Integrated Project (RCIP), Riverside is attempting to manage future growth by simultaneously planning for it at three interdisciplinary levels: environmental, residential/commercial and transportation.

The crux of the plan essentially trades pockets of density for increased open space. As such, the pockets of moderate density keeps development from sprawling as well as allowing for the potential for varied transportation options — namely, transit (think Metrolink versus freeway). However, the RCIP applies to the unincorporated areas of Riverside County and not the already established cities, so it’s not an all-inclusive solution. Moreover, will the county and developers reasonably follow the “blueprint for tomorrow” as outlined?

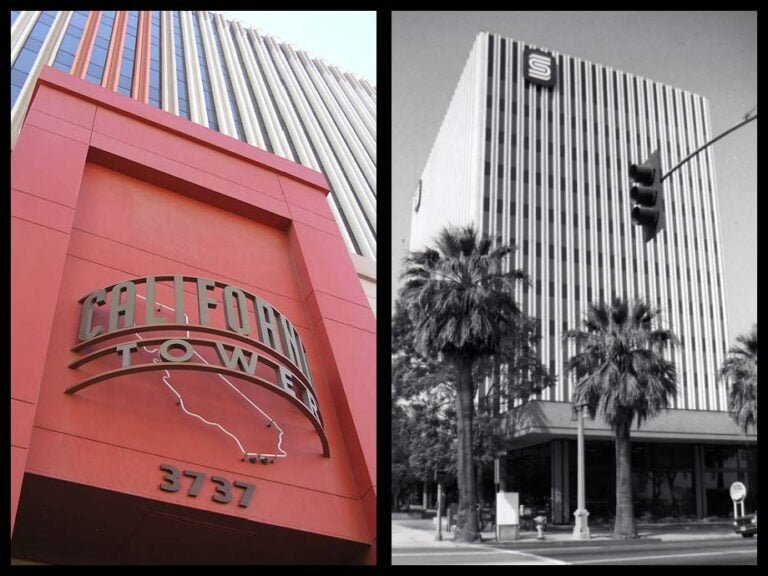

As previously stated in a recent post, we’re not envisioning New York City densities, but limited pockets of greater intensity, particularly in the existing downtown areas of Riverside and San Bernardino and portions of Ontario. In essence, we’re simply going to have to begin accepting more mid- and high-rise projects.

In other words, it’s time to begin growing up, both figuratively and literally.

Related

- San Bernardino Sun – Wells Fargo merging offices at SB building

- Riverside Press-Enterprise – Developers eye next Inland housing hot spot

- Riverside County Integrated Project (RCIP)

Previous

- RaincrossSquare.com – Time to grow up (July 2007) | Mixed-use projects picking up steam in Riverside (July 2007) | Site cleared for downtown Riverside office building (April 2007) | Census: Riverside County third in total residents added since 2000 (March 2007) | 4 million and counting (Dec. 2006) | Inland growth driving SoCal region (Dec. 2006) | ‘A Sleeping Giant’ – part deux (Feb. 2006)

Sources: California Department of Finance, County of Riverside, Riverside Press-Enterprise, San Bernardino Sun